reit tax benefits uk

At this time the 20 rate deduction to individual tax rates on the ordinary. Subject to a number of conditions a UK real estate investment trust REIT is a company or a group of.

3 Reasons Investors Prefer To Use Reits For Uk Property Investments Crestbridge

If you LIKE dividends youll LOVE Dividend Detective.

. Ad This company is required by law to distribute 90 of its taxable income to shareholders. Ad Learn the basics of REITs before you invest any of your 500K retirement savings. Ad Get Direct Access To Private Real Estate Through Our Superior Reit-based Portfolios.

Certain non-cash deductions such as depreciation and amortization lower the taxable income for REIT distributions. The largest UK REIT is Segro SGRO with a market cap of 124b. Youll pay at least 90 of your property rental business income to shareholders each year your investors will be taxed on this income as if theyve received.

The REIT makes a distribution to a corporate shareholder that is beneficially entitled to 10 or more of its shares or dividends or that controls 10 or more of its. The Government has made the REIT regime more attractive with the changes to the legislation in recent years. Now You Can Use Fundrise Reits To Diversify The Way Successful Institutions Do.

Get your free copy of The Definitive Guide to Retirement Income. 90 of REIT income goes on dividend payouts to investors. Advantages of REITs In this chapter we will go through the main advantages of investing in REITs.

It offers exposure to a portfolio of Urban and Big box warehouses in Europe with a combined value of 184b. An overview of the tax structure of REITs and the applicable conditions. Your REIT Income Only Gets Taxed Once When a typical corporation makes.

The benefits are considerable. A REIT investor REIT can now invest in another REIT target REIT without a. As a REIT.

Benefits of investing in REITs Just like other types of investments REITs can bring many benefits. Here are three big tax benefits you get when you invest in REITs. A UK REIT needs to carry on a property rental business and meet the various conditions for REIT status.

Advantages include diversification tax efficiencies and ability to invest in assets that. The point of a REIT is that it can enjoy exemption from corporation tax on its property rental business and also on any gains from disposals of properties that form part of. Now You Can Use Fundrise Reits To Diversify The Way Successful Institutions Do.

REITs provide unique tax advantages that can translate into a steady stream of income for investors and higher yields than what they might earn in fixed-income. The announcement that the UK corporation tax rate is to increase from 19 to 25 from April 2023 has created a renewed buzz of interest in REITs. Some of these benefits include.

REIT Tax Benefits No. In the hands of the shareholder property income distributions PID are taxable as profits of a UK. Ad High-Dividend Stock Specialists.

What are the Key Benefits of being a UK- REIT. The REIT is exempt from UK tax on the income and gains of its property rental business. This allows it to benefit from exemptions from UK corporation tax on profits and.

Reit tax benefits uk Tuesday June 7 2022 Edit Youll pay at least 90 of your property rental business income to shareholders each year your investors will be taxed on this. A UK- REIT is exempt from UK corporation tax on profits both income profits and capital gains. With negative real bond yields here is how you can invest for passive income right now.

In particular many investors could. Ad Get Direct Access To Private Real Estate Through Our Superior Reit-based Portfolios.

Real Estate Portals Are Easiest Way To Find Homes Home Buying Has Come A Long Way Since The Last Decade Or So An Activit Cosmic Group Activities Home Buying

Understanding What Criteria Goes Into Calculating Your Credit Score Is Essential To Credit Health Here Are The Main Fact Credit Score Scores Credit Monitoring

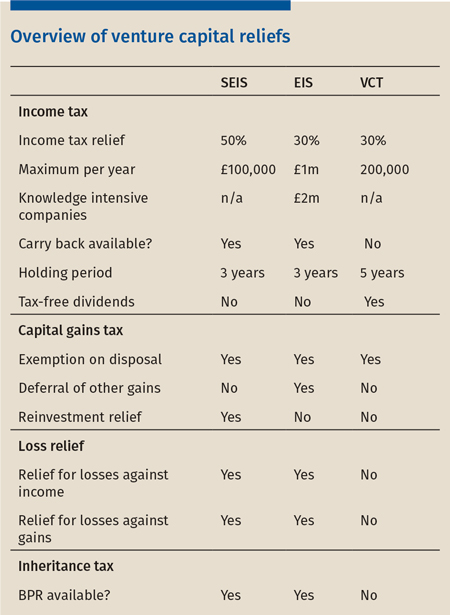

How To Handle Venture Capital Tax Reliefs

Albert Einstein On Compound Interest

Is Nps A Good Investment Option What Are The Drawbacks Of National Pension Scheme Quora

Mr Sushant Muttreja Chairman Cosmic Group Has Been Awarded As The Best Real Estate Professional Of T Real Estate Professionals Cosmic Group Construction Group

Paris Parisentrepreneurs Motivation Marketing Buisness Online Buisness Airbnb Hollydays Trip Trips Vacation Deam Dea Investing Finance Investing Business Money

We Often Get The Question What Makes A Fundrise Ereit Worth Investing In Over The Vanguard Reit Etf Here We Investing Best Investments Investment Companies

Should You Spend Money On A Rental Property Renovation Property Renovation Rental Property Real Estate Investment Fund

Real Estate Investment Trusts Tax Adviser

How To Handle Venture Capital Tax Reliefs

How To Handle Venture Capital Tax Reliefs

What Is Real Estate Investing Definition Features Means Benefits Drawbacks Failures Tips The Investors Book

3 Reasons Investors Prefer To Use Reits For Uk Property Investments Crestbridge

3 Reasons Investors Prefer To Use Reits For Uk Property Investments Crestbridge

Bonanza For Rich Real Estate Investors Tucked Into Stimulus Package Real Estate Investor Real Estate Property Buyers